Deductibles, Out-of-Pocket Expenses, and Keeping Your Present Doctor

Out-of-pocket expenses

The Marketplace (your state health insurance exchange or the federal exchange depending on where you live) cost-sharing reduction lowers the amount you have to pay for out-of-pocket costs like deductibles, coinsurance, and copayments. Health insurance companies offering coverage through the Marketplace must lower the amount you pay out of pocket for essential health benefits if your household income is below the following amounts. (Incomes below are based on 2013 numbers.)

Up to $28,725 for individuals

Up to $38,775 for a family of 2

Up to $48,825 for a family of 3

Up to $58,875 for a family of 4

Up to $68,925 for a family of 5

Up to $78,975 for a family of 6

Up to $89,025 for a family of 7

Up to $99,075 for a family of 8

Under the law, the maximum amount a consumer with single coverage will pay out-of-pocket in 2014 will generally be $6,350 while a family could pay up to $12,700. Those totals include copayments and deductibles, but not premiums, and they apply only to plans that are not grandfathered under the law. According to guidance from the federal government issued in February, 2013 health plans with more than one benefits administrator don’t have to combine their tallies of members’ out of pocket spending into one total until 2015. So a plan with a separate cap on pharmacy benefits can keep it as long as the limits don’t exceed the new maximum. Plans with no drug spending limit—the norm, according to experts—don’t have to cap members’ out-of-pocket spending at all. Drug costs can add up fast.

Deductible.

Zero-deductible plans are most common at the platinum level, the highest tier of coverage. Some 41% of platinum plans charge no deductible, according to an analysis by HealthPocket of the plans offered in 34 of the 36 states that sell plans on HealthCare.gov. In contrast, only 6% of gold plans and 3% of silver plans have no deductible, and the option is available with few if any bronze-level plans. One way to look this is to base your metal level choice on what you expect your medical expenses to be in the coming year. If you anticipate having to a lot of medical treatment and prescriptions drugs, it might make more sense to pay for the more expenses plans with the lowest deductible and out-of-pocket expenses. If you are not expecting much medical expenses in the coming year, go for the lower cost plan with the higher deductible and out-of-pocket expenses.

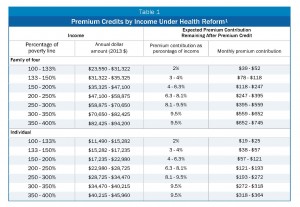

If your combined income is below 400% of the federal poverty level ($92,400 for a family of four) you can also receive tax credits and in some states premium assistance to pay for your insurance. Check this link to see what assistance you might qualify. http://kff.org/interactive/subsidy-calculator/

Keeping your present doctor

If you want to keep seeing certain doctors, you should research before deciding which plan level to choose. We always recommend calling your preferred doctor and asking if he in in the network and will accept payment from the insurance provider. Most insurance providers have a link where you can check to see if a doctor is in their network. (Note: this is for PPO’s not HMO’s which are more restrictive on who you can see).