Points to Consider if You’re a Small Business and Thinking About Enrolling In Obamacare

First there is no requirement that small businesses (less than 50 full-time employees) provide insurance for their employees.

The pitch being made by Covered California why small businesses should provide insurance is:

- Employee loyalty

- Covered California’s SHOP offers high-quality, affordable health insurance to help attract and retain talented employees.

- Productivity

- Health insurance can help prevent illness, increase productivity and reduce employee absenteeism.

- Financial control – You decide the level of coverage and how much to contribute toward premiums.

- Tax advantages – You may be eligible for a tax credit after purchasing insurance through SHOP.

- Simple billing – All health plan premiums are billed in one consolidated monthly invoice.

How SHOP will benefit your employees:

- Employee choice – Employees decide which health plans and corresponding networks of doctors and hospitals meet their needs and lifestyles.

- Live support

- Plan selection and enrollment support from Certified Insurance Agents (that’s me).

- Customer service

- Access to a multilingual service center for ongoing support.

Here’s a more detailed breakdown on what’s involved:

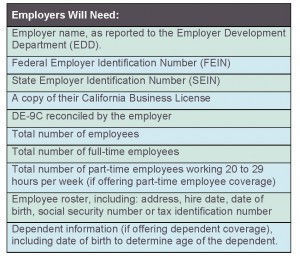

- A list of what you will need if you want to apply.

Small businesses eligible to purchase health insurance through the SHOP are those that:

- Have 1 to 50 eligible employees. An eligible employee works an average of 30 hours per week based on a month of work. Employers may also choose to offer coverage to their part-time employees who work between 20 and 29 per week.

- Elect to offer, at a minimum, all full-time employees coverage in a Covered California Health Insurance Plan through the SHOP;

- Contribute a minimum of 50% of the lowest cost employee-only premium in the metal tier the employer selects; and

- Have the majority of and their employees employed in California.

California defines an eligible employee as one who works an average of 30 hours per week, measured on a monthly basis. Employers may elect to offer coverage to their part-time employees who work at least 20 hours but no more than 29 hours per week. Part-time employees count in the total employ count, which cannot exceed 50.

Additionally, eligible employees must be permanent and actively engaged in the business of the employer or becomes an eligible employee once the offer of coverage is made by the employer.

Sole proprietors with employees are eligible to purchase coverage through the SHOP. However, small businesses that operate as sole proprietorships but have no employees are not eligible.

Beginning in 2015, Covered California’s SHOP will be available to employers with 1 to 100 eligible employees, for coverage effective January 1, 2016.

Small businesses that choose to offer coverage through the SHOP must:

- Offer coverage to all full time employees (employees working an average of 30 hours per week.

- Meet a minimum employee participation rate of 70%

- Contribute a minimum of 50% of the cost of the least expensive plan in their selected metal tier toward their employees’ eligible premium.

- Although Federal regulation does not require employee choice prior to January 1, 2015, California has elected to implement employee choice beginning January 1, 2014. Employee choice permits employers to determine a level of coverage from one of the four metal tiers (e.g. Platinum, Gold, Silver and Bronze) and the amount they want to contribute toward their employee’s premium. Under this employer “defined contribution” arrangement employees will then be able to select from any health plan offered in the metal tier the employer selected.

Tax Credits

Small businesses may qualify for tax credits if they:

- Have fewer than 25 full-time equivalent employees for the tax year (example: two part-time workers count as one full-time-equivalent employee)

- Pay employees a combined average wage that does not exceed $50,000 per year

- Contribute at least 50 percent toward their employees’ premium costs―this contribution requirement also applies to add-on coverage such as vision, dental, and other limited-scope coverage

- Taxable employers with fewer than 10 full-time equivalent employees with wages averaging less than $25,000 per year that contribute a minimum of 50% toward their employee’s premium may qualify for the maximum tax credit.